We Bring the Best of Social Trading to Banks & Brokers

Activate, engage, and grow your user base

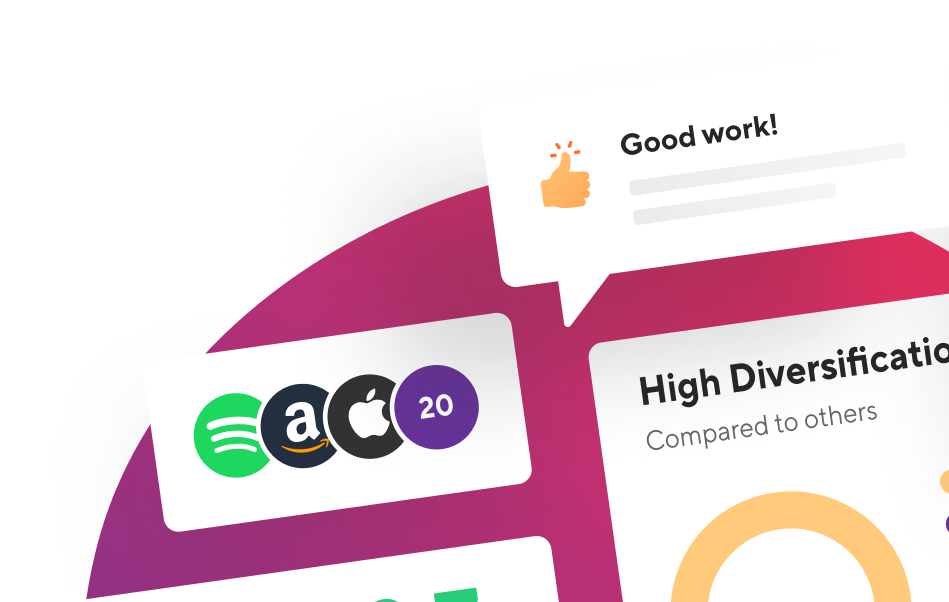

With our investor benchmarking, portfolio analysis, social networking, climate impact rating, and other engaging features, we can get you there.

Increase in transactions

Average minutes per session

Greater returns for investors

"StockRepublic's idea reflects the current zeitgeist and shows that social trading is becoming mainstream. Overall, it makes retail trading more accessible, social, and transparent."

- Björn Andersen, Head of Brokerage at comdirect

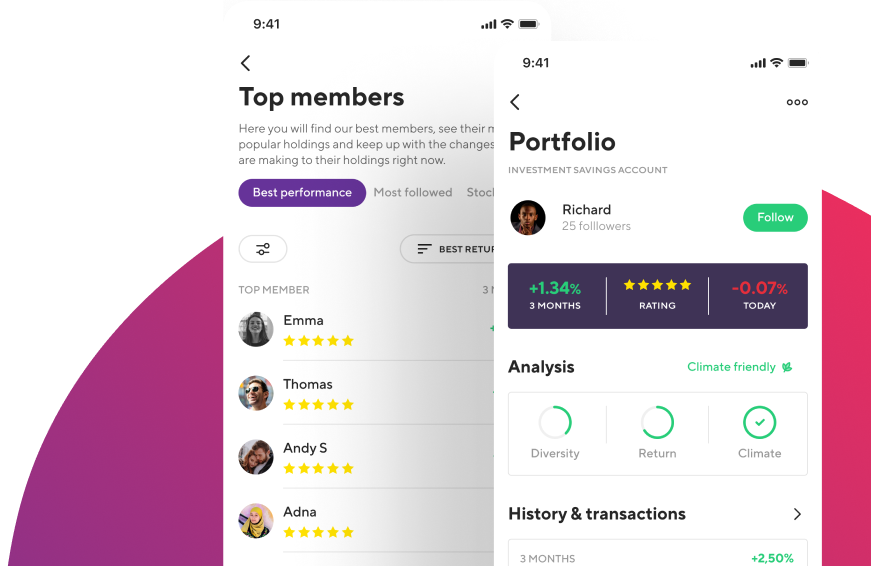

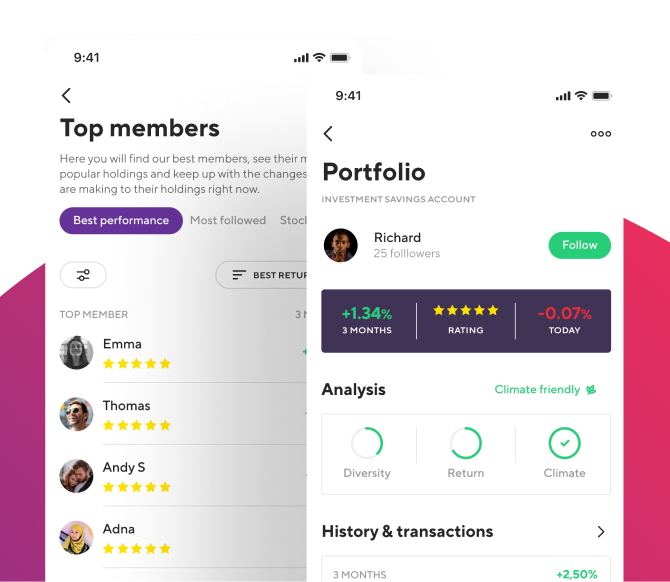

White label app

A fully customizable, white label social trading mobile & web app for your brokerage. Built with compliance in mind. Ready to launch in weeks.

API

Integrate StockRepublic's social trading features with your platform. Own the customer experience with no technical debt.

"We were looking for a fast-paced provider with the knowledge and experience to create a modern and scalable solution for social trading. So when we reached out to StockRepublic, it clicked right away."

- Johan Kleis, CEO at Placera (subsidiary of Avanza Bank)

Safe & Compliant Social Trading

We've meticulously designed our social trading tools with strict compliance measures to ensure a secure, transparent, and legal experience. From preventing market manipulation to protecting user data, we implement rigorous standards. This includes thorough user verification, portfolio transparency, and advanced content moderation.

Identified users: All logged-in users are verified and vetted through regulatory KYC and AML processes. While they remain anonymous from each other, this level of identification helps discourage and detect any collusive activities.

Transparency & accountability: Our solution aligns users' portfolio activities with their posts and comments, allowing for clear visibility of any potentially manipulative behavior.

Moderation: We utilize advanced moderation tools to detect suspicious behavior and take immediate action. These tools are effective in both open forums and closed groups.