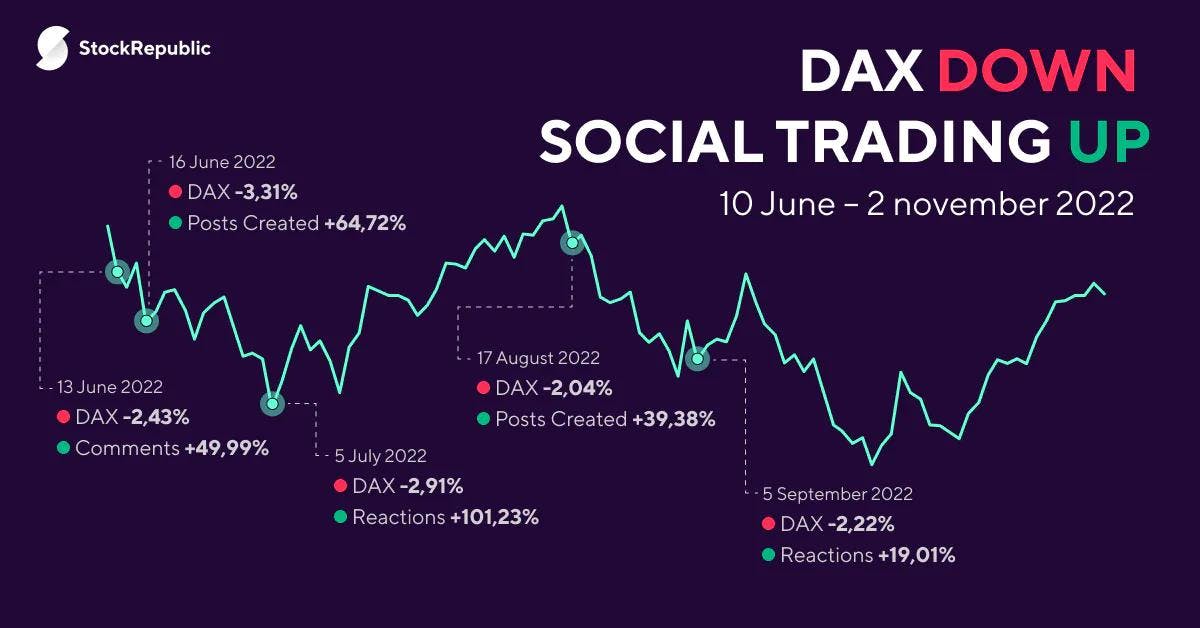

When the DAX Goes Down, Social Trading Goes Up

Here at StockRepublic, we have some unique insights from hi!stocks; the social network made explicitly for comdirect and their customers. Last week we pulled some data to showcase the correlation between DAX movements and engagement rates for social trading.

The data is pulled from trading days with a downward DAX movement of at least 2% since the hi!stocks app went live (May 11) until Nov 2. Therefore, the total sample size includes a total of eight different trading days during this period.

On July 5, for example, the DAX index dropped by -2.91% and was, from that perspective, one of the worst trading days for the hi!stocks community. On the back of that, we could see the following increases in engagement (vs. average) as a result:

- Posts created: +26.7%

- Comments: +54.1%

- Reactions: +101.2%

Compared to average numbers, and therefore, July 5 actually proved to be one of the best social trading days for hi!stocks. Furthermore, the average social engagement of the eight trading days from the sample still paints a clear picture of the correlation between DAX index performance and social engagement:

- Posts created: +12.5%

- Comments: +19.1%

- Reactions: +26.9%

Another fun fact – when we see a DAX movement of -2% or more, the hi!stocks app attracts 10% more visitors than on average.

What is the moral of the story? People turn to their community in times of uncertainty, and we are happy to provide one.