This guide seeks to unravel the ins and outs of social trading, its distinction from copy trading, how to maintain user privacy, prevent market manipulation, and distinguish the difference between advice and guidance.

Social Trading vs. Copy Trading: Understanding the Differences

While both social trading and copy trading foster shared learning and engagement in the trading community, they have distinct features catering to different investor needs.

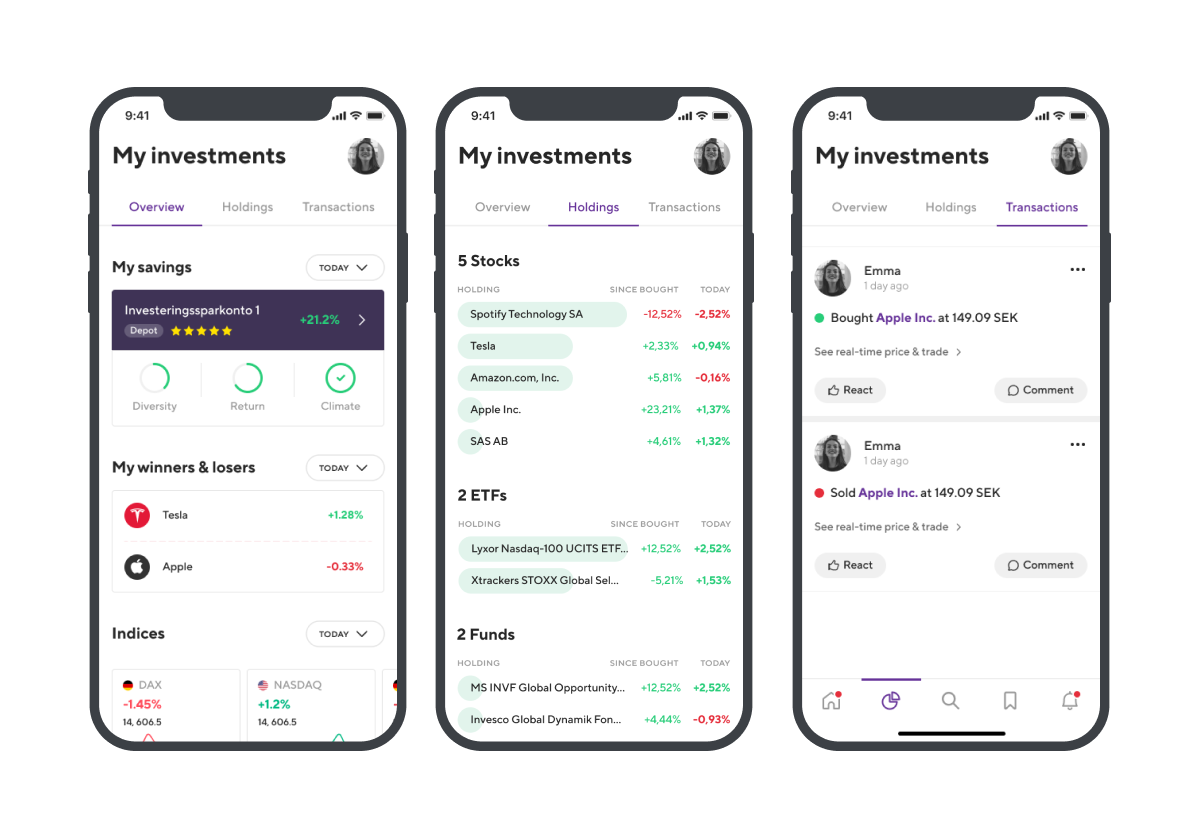

Social Trading: This approach offers a more engaged, participatory trading experience. Investors learn from each other, share their insights, and base their investment decisions on collective wisdom. It's an active, hands-on approach, beneficial for those eager to learn and manage their own investments. The prime focus of social trading is to create a community of informed investors who contribute to and benefit from shared knowledge and experience.

Copy Trading: Contrarily, copy trading offers a more passive, hands-off investment experience. It involves replicating the trades of successful investors automatically. The trader merely chooses an expert trader to follow, and their trades are copied automatically into the follower's account. This approach is suitable for those lacking the time or expertise to manage their trades actively. It allows beginners to profit from the strategies of successful traders – and experienced traders to earn commissions when others copy their trades.

Preventing Market Manipulation

Although there is a theoretical risk of social trading being used for market manipulation, we at StockRepublic have implemented robust measures to combat such activities. Our preventive steps hinge on three core principles: user identification, transparency & accountability, and effective moderation.

Identified users: All logged-in users are verified and vetted through regulatory KYC and AML processes. While they remain anonymous from each other, this level of identification helps discourage and detect any collusive activities.

Transparency & accountability: Our solution aligns users' portfolio activities with their posts and comments, allowing for clear visibility of any potentially manipulative behavior.

Moderation: We utilize advanced moderation tools to detect suspicious behavior and take immediate action. These tools are effective in both open forums and closed groups.

User Data Requirements and Anonymization

We strictly adhere to data protection and privacy measures, requiring only our end users' holdings and transaction history data. These data points are tagged to an anonymized user identifier provided by the financial institution, ensuring we never handle sensitive personal information.

We implement data anonymization measures, meaning that we never disclose which customer owns what. Users' holdings and transactions are revealed only as percentages of their total portfolio, safeguarding their financial information and maintaining a fair playing field.

Content Moderation

With our white label app, StockRepublic takes on content moderation responsibilities, while our social trading API customers are responsible for moderating their own content, aided by our tools. Our moderation tooling removes inappropriate posts, suspends accounts for breaking the rules, and encourages self-reporting among members.

We actively moderate illegal, abusive, or infringing content, maintaining a positive and respectful user environment. Any infringement of our guidelines can lead to the review, deletion, or banning of users.

Avoiding Conflicts of Interest

To prevent conflicts of interest, we do not compensate any contributors on the platform. Our mission is to create a community that fosters transparency without any hidden vested interests.

We deter users from market manipulation practices like share price ramping through anonymity and a ranking system based on risk-adjusted returns. The platform's transparency makes it easy to identify and report any manipulative behavior.

Distinguishing Between Advice and Guidance

Drawing the line between advice and guidance is critical in a social trading environment. Here, users share personal investment suggestions, which are considered guidance rather than advice, since the financial institution or StockRepublic does not employ them. This clear separability ensures our customers are at "arm's length" from end users' suggestions and ideas.

Responsibility and Controls

Regulatory bodies have not raised issues concerning the distinction between advice from the bank and social interactions on forums. StockRepublic and its partner banks take full responsibility for the controls and processes to maintain compliance and protect the interests of all stakeholders.